The Big Chill

Amidst a cooling real estate market, Canada plans legislation that may chill short-term rentals, affecting homeowners and the housing sector.

The Government of Canada has its sights set on reining in on the housing affordability crisis by tackling short-term rentals. The impending legislation has sparked conversations not only about its immediate effects but also about the broader implications for the housing market.

The crux of the matter lies in the specifics of the federal legislation. Homeowners accustomed to supplementing their income through short-term rentals may find the rug pulled out from under them. The Toronto Star has revealed that one key change is the disallowance of claiming rental expenses against the income generated, signaling a potential financial hit for those who have embraced the sharing economy.

This move comes at a time when policymakers at all levels of government are intensifying their efforts. The aim is to navigate the challenges posed by higher interest rates and increased government spending which have impacted the overall affordability for the consumer, setting the stage for a more regulated housing sector.

The timing is intriguing. As the Canadian housing market experiences an uncharacteristic slowdown ahead of the winter months, the introduction of this legislation adds a new layer of uncertainty. Picture this: Toronto, with over 19,000 units listed as short-term rentals in Toronto alone, over 50 per cent of these listings have not had one booking in the past 12 months.

The question on everyone's mind is whether this legislation could plunge the market into a deep freeze. The current housing market slowdown already raises concerns, and the introduction of new regulations adds another layer of complexity. The impact might be felt differently across regions, with some areas facing a more severe chill than others.

There is also a distinct concern about how this legislation could affect those genuinely trying to make ends meet. For honest homeowners who have diligently followed local rules and regulations, the potential financial strain is palpable.

Renting out a portion of your home place has become a lifeline for some. It helps me with mortgage obligations and increases affordability, but with these new rules, homeowners could be looking at a substantial dent in their income.

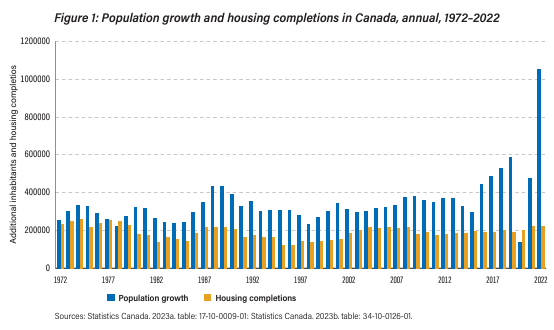

This move by the federal government is just one piece of the puzzle in the larger housing affordability crisis in Ontario. The Fraser Institute highlights the lag in homebuilding compared to population growth, a key factor contributing to the escalating cost of housing.

As the Canada Mortgage and Housing Corporation (CMHC) estimates that 1.85 million homes must be built in the province by 2030 to restore affordability, the need for comprehensive measures becomes increasingly evident.

Governments at all levels are urged to work together to bridge the widening gap between population growth and housing completions. The call to action includes relaxing zoning laws, reducing developer fees, and expediting permit processes.

As we navigate the intricate landscape of Canadian real estate, the impact of federal legislation on short-term rentals is just one chapter. It's a move that seeks to address immediate challenges but prompts us to question whether it's a short-term solution to a long-term problem.

As the regulatory winds of change blow through the real estate sector, only time will tell whether they bring a thaw or a prolonged winter chill.